Lifestyle Reimbursement Accounts – Stats & Figures

Looking Ahead

Benefits focused on well-being for employees across different aspects of their lives – financial, physical and emotional – are becoming more important in the employee benefits landscape. Many employers are investing money in Lifestyle Reimbursement Accounts with employees’ overall health in mind.

Five Key Areas of Employee Well-Being*

Forbes identifies five key levels of employee well-being.

Financial Well-Being |

|

Mental Health Well-Being |

|

Social Well-Being |

|

Physical Well-Being |

|

Career Well-Being |

|

*Source: Forbes, “The Future of Work: Offering Employee Well-Being Benefits Can Stem the Great Resignation”

Importance of Employee Well-Being Support Programs While Considering Next Job*

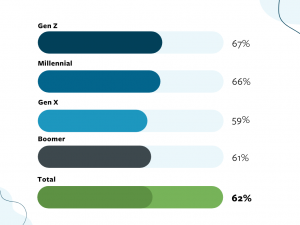

Employers are also considering how well-being benefits impact talent and recruitment efforts. 6 in 10 employees say well-being support will be a top priority when applying for new jobs. Implementing a Lifestyle Reimbursement Account can help organizations stay competitive in a demanding job market.

Key Findings

- Gen Z and Millennials are most likely to report well-being benefits to be a top priority when applying for their next job.

- Employees who work in a hybrid environment are more likely (68%) to report well-being benefits as a priority in applying for a new job.

*Source: Forbes, “The Future of Work: Offering Employee Well-Being Benefits Can Stem the Great Resignation”