2FA for P&A Participants

With rising healthcare costs, companies are taking a closer look at employer-saving strategies. For example, one area worth examining is Flexible Spending Accounts. Yes, that’s right – Flex plans offer significant saving opportunities, especially for medium to large size employers. Here’s what you should consider when discussing how an FSA can contribute to employer savings.

As you probably already know, employees who participate in a Flex Spending Account save on state, federal and FICA taxes (Social Security taxes). On average, this produces approximately 30% savings for participants. On the other hand, do you know that FSAs also save employers money?

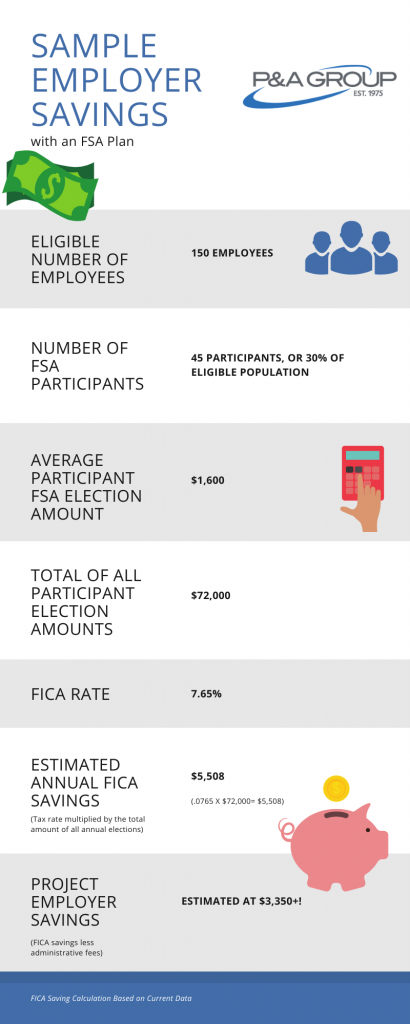

For every employee who enrolls in an FSA, employers receive the same matching FICA savings, or 7.65% of the total dollar amount. This means that the more FSA participants there are, the more matching FICA savings employers receive. Since this is a case where volume yields more savings, companies with a higher volume of FSA participants are more likely to experience greater savings.

Let’s examine the below example. Company ABC has 150 eligible employees, of which 45 sign up for a Flex Spending Account. The total annual election amounts among all 45 participants is $72,000. The estimated annual FICA savings is $5,508. Subtract that number from any administrative fees and you’re looking at anywhere from $3,350 or more in savings!

Growing your FSA plan can lead to employer savings – but how do we grow your plan? When you partner with us, we first focus on how we can integrate into your group’s existing benefits package. Then, we examine different opportunities to increase your plan’s growth, such as education.

One of the most important components to any successful benefits program is education. We provide a suite of tools and resources to help educate your workforce on all things FSA: from our Penny Panda videos, to customized marketing pieces tailored to your group’s specific plan, we work with employers to develop a communications strategy that is unique and meaningful to your group. We also have a team of benefits consultants available for on-site meetings and benefit fairs.

We provide three areas of expertise that many other companies simply don’t offer:

One of our clients – a large state government– saw over a 91% increase in participation with our help. In 2013, the group had 25,028 participants. Fast forward to 2020, and the same group has almost 50,000 employees enrolled in their FSA plan!

Steady growth – with a proper plan – is key to increasing your FSA participation and unlocking your employer savings. To learn how we can help you, contact P&A’s Benefit Consultants.