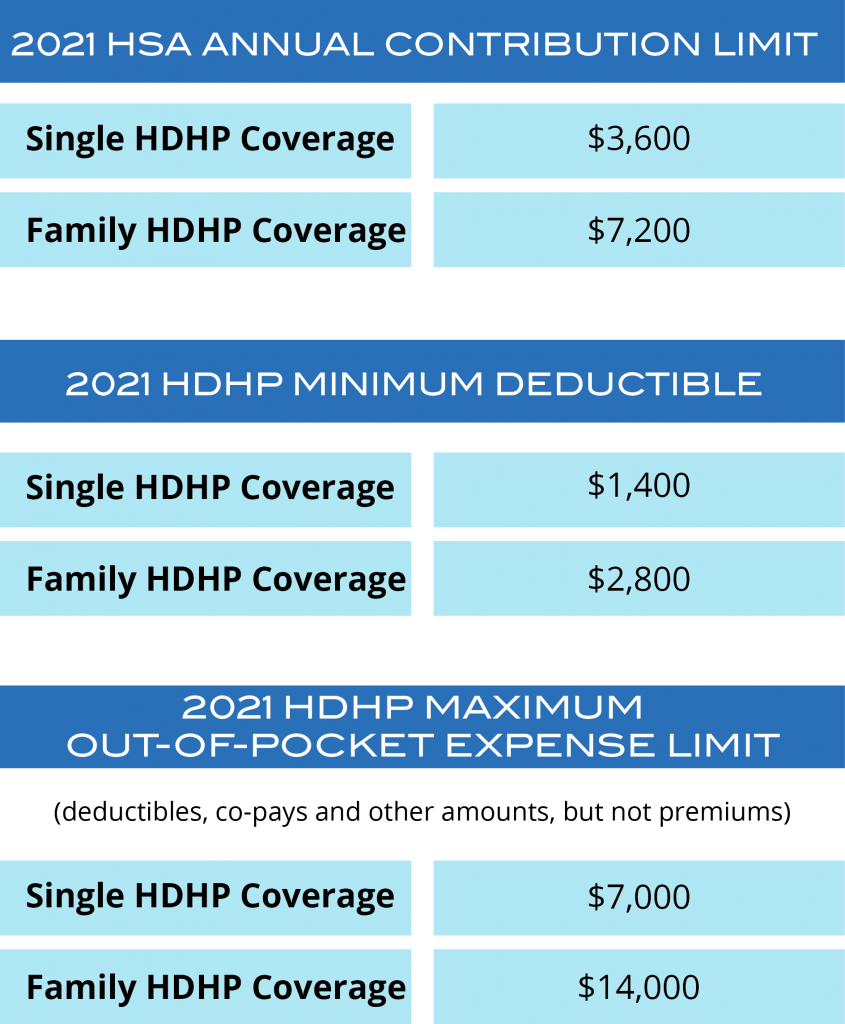

On May 21, 2020, the IRS announced the 2021 HSA contribution limits for Health Saving Accounts (HSA). The following increases are effective January 1, 2021:

2021 HSA Contribution Limits

Individuals with single HDHP coverage will see a $50 increase in the annual contribution limit, bringing the maximum limit to $3,600 for 2021. Families with family HDHP coverage will see a $100 increase in the annual contribution limit, bringing the maximum limit to $7,200 for 2021.

Annual HDHP Minimum Deductible- No Change

The minimum deductible imposed for a qualifying high-deductible plan for 2021 remains the same for single coverage at $1,400. It also remains the same for family coverage at $2,800.

Out-of-Pocket Maximums

Annual out-of-pocket expenses will increase in 2021, with a new maximum limit of $7,000 for single coverage and $14,000 for family coverage.

Pro Tip: OTC items can be purchased with your HSA under the CARES Act. View five common OTC expenses that are now eligible.

Pro Tip: OTC items can be purchased with your HSA under the CARES Act. View five common OTC expenses that are now eligible.

To learn more about our HSA service, please contact us.