2FA for P&A Participants

![]()

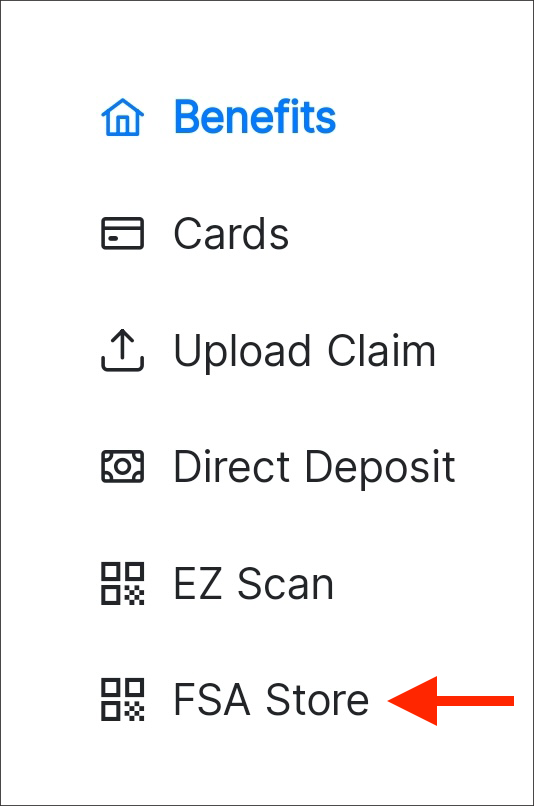

P&A’s vendor partner FSA Store is now available on the P&A MyBenefits mobile app. Participants can access FSA Store directly from the main menu where you can:

FSA Store is designed to make healthcare spending easy and support account holders in maximizing their benefit dollars. FSA Store also offers an interactive eligible product list that is continuously monitored by industry experts.

Download MyBenefits mobile app on the App Store or Google Play. Once you download the app, tap the app and click “Log on to MyBenefits” where you will be directed to enter your P&A username and password.

Under parent company Health-E Commerce, FSA Store is a consumer health and wellness online retailer that offers a special marketplace for FSA exclusive eligible products. FSA Store also proudly provides educational resources for consumers to help account holders understand their plan and make the most use out of their tax-saving dollars.